Fixed Deposit

- Fixed Deposit Singapore

- Fixed Deposit Interest Rate In Singapore

- Fixed Deposit Calculator India

- Fixed Deposit Rates In India

- Fixed Deposit In Usa

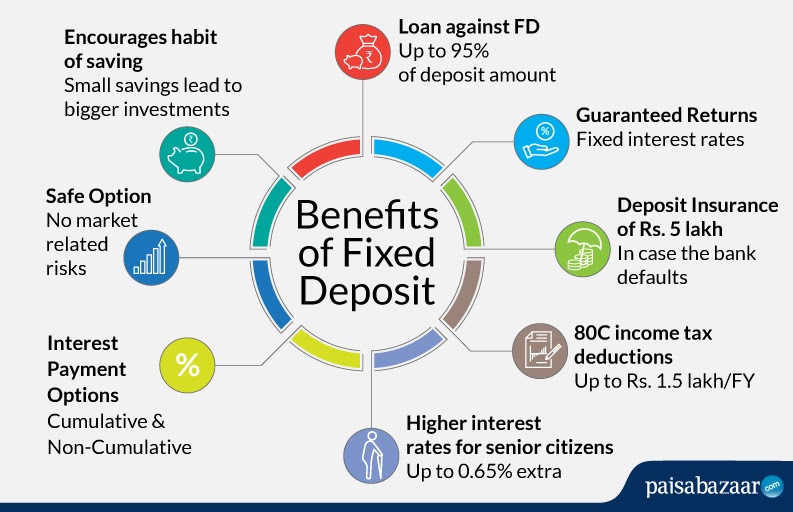

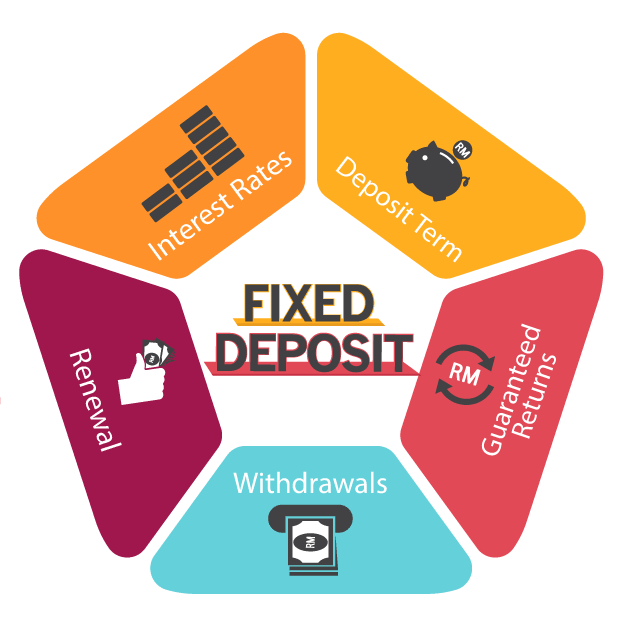

Five Year Tax Saving Fixed Deposit Get a combination of two benefits – saving tax while earning interest Save tax under section 80c of the Income Tax Act Invest. Fixed Deposit Calculator Online. A fixed deposit (FD) is a type of term investment offered by several banks and NBFCs. These deposits typically offer a higher rate of interest, subject to certain terms and conditions. The amount you deposit in an FD is locked for a predetermined period which can vary between 7 days and 10 years.

Fixed Deposit Singapore

Fixed Deposit Interest Rate In Singapore

|

|

Fixed Deposit Calculator India

Fixed Deposit Rates In India

Fixed Deposit In Usa

Enjoy competitive interest rates for your money invested for fixed periods! With a First Citizens Fixed Deposit Account you can be assured that your money grows safely and soundly. It means security for you and your family through medium to long- term savings. Invest wisely today by opening a First Citizens Fixed Deposit Account. TTD Fixed Deposits

USD Fixed Deposits

Additional Benefits

Please note: The Policy of the Bank concerning the payment of interest on Fixed Deposits broken before maturity is as follows:

|